Three Reports that Simplify Tax Season

With tax season quickly approaching, it’s never too early to start prepping for it. Did you know that Zen Planner can make tax season a little easier for you? Be sure to check out the following three reports that will give you vital information you need when completing taxes for your gym, studio or school.

Gross Sales Tax

Zen Planner enables you to pull an easy-to-view report showing your gross sales tax for an entire year. To pull this report, click Dashboard > Finances (under Saved Reports) > click the Gross Sales Revenue Report > input the criteria below.

Get your free copy of our 7-Step Guide to Tax Season for Fitness Business Owners!

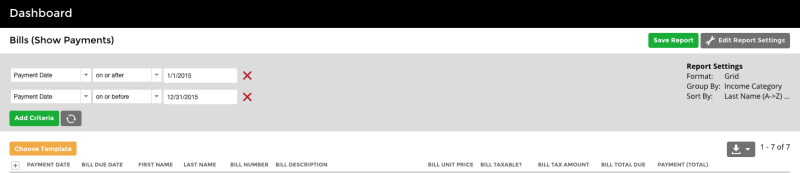

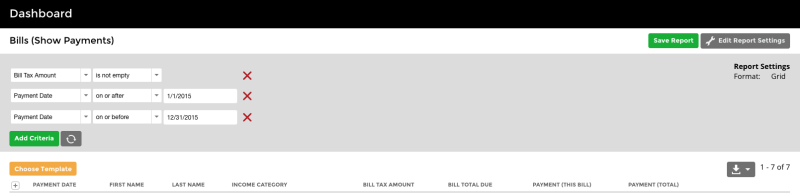

Bill Tax Amount (Services)

As a business that employs instructors, coaches or trainers, you offer services to many members of your community. If you need to determine taxes specifically on your services, be sure to pull the Bill Tax Amount Services report. To pull this report, click Dashboard > +New Report > Click Bills (show payments) report > input the criteria below.

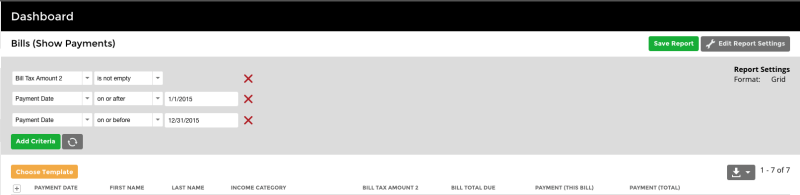

Bill Tax Amount (Retail)

Do you sell supplements, snacks or water? What about small equipment like foam rollers, jump ropes or grips? Have you created branded gear, like tanks, sweat shirts and t-shirts for your members to wear around town? If so, you’ll likely need to see your taxes solely for retail. To see this in Zen Planner, click Dashboard > +New Report > click Bills (show payments) report > input the criteria below.

Remember, Zen Planner’s Staff App can also simplify retail sales so you no longer have to use the honor system for tracking purchases or manually recording transactions.

If you’re looking to make future tax seasons a little easier, we have you covered! You can save each report for future use by clicking the Save Report button in the top right hand corner of your account. Once you’ve clicked this button, name the report, select the category of your choice and don’t forget to save your changes.

Happy tax season!

Your friends at Zen Planner

Make tax season a little less stressful. Get your free copy of our 7-Step Guide to Tax Season for Fitness Business Owners.

I’m Coach Kelli, a devoted CrossFit gym owner with 15 years of experience managing my facility, along with owning yoga studios and wellness centers. Beyond the fitness world, I have a passion for cooking, cherish moments with my children and family, and find joy in spending time outside. Having experienced the highs and lows, I’m dedicated to leveraging my expertise to help you grow and succeed on your fitness journey.

I’m Coach Kelli, a devoted CrossFit gym owner with 15 years of experience managing my facility, along with owning yoga studios and wellness centers. Beyond the fitness world, I have a passion for cooking, cherish moments with my children and family, and find joy in spending time outside. Having experienced the highs and lows, I’m dedicated to leveraging my expertise to help you grow and succeed on your fitness journey.